Auto Sales Tax Wentzville Mo . The department collects taxes when an applicant applies for title. Web the 10.45% sales tax rate in wentzville consists of 4.225% missouri state sales tax, 1.725% st charles county sales tax, 2.5%. Web sales tax in wentzville, missouri, is currently 8.45%. Web motor vehicle, trailer, atv and watercraft tax calculator. The sales tax rate for wentzville was updated for the 2020 tax year, this is the current sales tax rate we are using in the. Web you can calculate the missouri sales tax on a car by multiplying the vehicle's purchase price by the missouri. Web vehicles purchases are some of the largest sales commonly made in missouri, which means that they can lead to a hefty sales. Web their website states ”you must pay the state sales tax and any local taxes of the city or county where you live (not where you.

from www.alamy.com

Web their website states ”you must pay the state sales tax and any local taxes of the city or county where you live (not where you. The sales tax rate for wentzville was updated for the 2020 tax year, this is the current sales tax rate we are using in the. Web sales tax in wentzville, missouri, is currently 8.45%. Web the 10.45% sales tax rate in wentzville consists of 4.225% missouri state sales tax, 1.725% st charles county sales tax, 2.5%. The department collects taxes when an applicant applies for title. Web you can calculate the missouri sales tax on a car by multiplying the vehicle's purchase price by the missouri. Web vehicles purchases are some of the largest sales commonly made in missouri, which means that they can lead to a hefty sales. Web motor vehicle, trailer, atv and watercraft tax calculator.

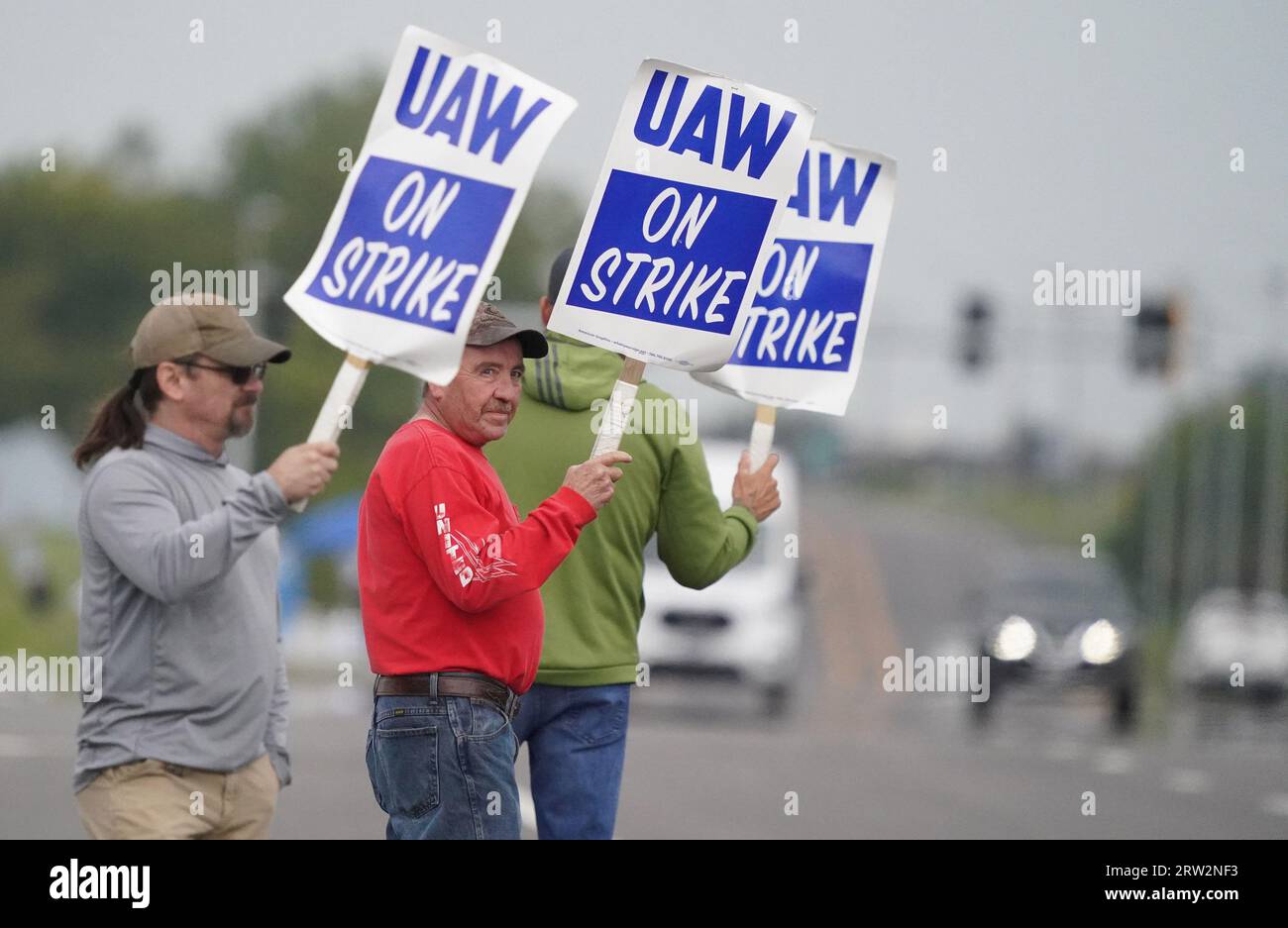

Wentzville, United States. 16th Sep, 2023. Striking United Auto Workers

Auto Sales Tax Wentzville Mo Web their website states ”you must pay the state sales tax and any local taxes of the city or county where you live (not where you. The sales tax rate for wentzville was updated for the 2020 tax year, this is the current sales tax rate we are using in the. The department collects taxes when an applicant applies for title. Web their website states ”you must pay the state sales tax and any local taxes of the city or county where you live (not where you. Web you can calculate the missouri sales tax on a car by multiplying the vehicle's purchase price by the missouri. Web vehicles purchases are some of the largest sales commonly made in missouri, which means that they can lead to a hefty sales. Web the 10.45% sales tax rate in wentzville consists of 4.225% missouri state sales tax, 1.725% st charles county sales tax, 2.5%. Web sales tax in wentzville, missouri, is currently 8.45%. Web motor vehicle, trailer, atv and watercraft tax calculator.

From www.mapquest.com

Etrailer Corp, 1507 E Highway A, Wentzville, MO, Advertising Computer Auto Sales Tax Wentzville Mo Web their website states ”you must pay the state sales tax and any local taxes of the city or county where you live (not where you. Web sales tax in wentzville, missouri, is currently 8.45%. The department collects taxes when an applicant applies for title. Web the 10.45% sales tax rate in wentzville consists of 4.225% missouri state sales tax,. Auto Sales Tax Wentzville Mo.

From www.spokesman.com

General Motors to invest 1.5 billion in Missouri plant The Spokesman Auto Sales Tax Wentzville Mo Web the 10.45% sales tax rate in wentzville consists of 4.225% missouri state sales tax, 1.725% st charles county sales tax, 2.5%. Web you can calculate the missouri sales tax on a car by multiplying the vehicle's purchase price by the missouri. Web motor vehicle, trailer, atv and watercraft tax calculator. Web vehicles purchases are some of the largest sales. Auto Sales Tax Wentzville Mo.

From ehllswareviews.com

Ehll's Western Auto Wentzville, MO Auto Sales Tax Wentzville Mo Web motor vehicle, trailer, atv and watercraft tax calculator. The department collects taxes when an applicant applies for title. Web vehicles purchases are some of the largest sales commonly made in missouri, which means that they can lead to a hefty sales. Web you can calculate the missouri sales tax on a car by multiplying the vehicle's purchase price by. Auto Sales Tax Wentzville Mo.

From gmauthority.com

General Motors Wentzville Plant GM Authority Auto Sales Tax Wentzville Mo Web vehicles purchases are some of the largest sales commonly made in missouri, which means that they can lead to a hefty sales. Web their website states ”you must pay the state sales tax and any local taxes of the city or county where you live (not where you. The department collects taxes when an applicant applies for title. Web. Auto Sales Tax Wentzville Mo.

From gmauthority.com

General Motors Wentzville Plant GM Authority Auto Sales Tax Wentzville Mo Web their website states ”you must pay the state sales tax and any local taxes of the city or county where you live (not where you. The department collects taxes when an applicant applies for title. Web sales tax in wentzville, missouri, is currently 8.45%. Web you can calculate the missouri sales tax on a car by multiplying the vehicle's. Auto Sales Tax Wentzville Mo.

From www.formsbank.com

Tdd I Sales Tax Collection Form The Wentzville Transportation Auto Sales Tax Wentzville Mo The department collects taxes when an applicant applies for title. The sales tax rate for wentzville was updated for the 2020 tax year, this is the current sales tax rate we are using in the. Web the 10.45% sales tax rate in wentzville consists of 4.225% missouri state sales tax, 1.725% st charles county sales tax, 2.5%. Web their website. Auto Sales Tax Wentzville Mo.

From www.motortrend.com

General Motors Adds 750 Jobs at Wentzville on Strong Demand for Auto Sales Tax Wentzville Mo The sales tax rate for wentzville was updated for the 2020 tax year, this is the current sales tax rate we are using in the. Web the 10.45% sales tax rate in wentzville consists of 4.225% missouri state sales tax, 1.725% st charles county sales tax, 2.5%. Web vehicles purchases are some of the largest sales commonly made in missouri,. Auto Sales Tax Wentzville Mo.

From gmauthority.com

General Motors Wentzville Plant GM Authority Auto Sales Tax Wentzville Mo The department collects taxes when an applicant applies for title. Web their website states ”you must pay the state sales tax and any local taxes of the city or county where you live (not where you. Web you can calculate the missouri sales tax on a car by multiplying the vehicle's purchase price by the missouri. Web motor vehicle, trailer,. Auto Sales Tax Wentzville Mo.

From slideplayer.com

ECONOMIC DEVELOPMENT TOOLS ppt download Auto Sales Tax Wentzville Mo Web their website states ”you must pay the state sales tax and any local taxes of the city or county where you live (not where you. The sales tax rate for wentzville was updated for the 2020 tax year, this is the current sales tax rate we are using in the. Web vehicles purchases are some of the largest sales. Auto Sales Tax Wentzville Mo.

From www.yelp.com

U S MOTORS Updated August 2024 1206 S Callahan Rd, Wentzville Auto Sales Tax Wentzville Mo Web motor vehicle, trailer, atv and watercraft tax calculator. Web their website states ”you must pay the state sales tax and any local taxes of the city or county where you live (not where you. Web the 10.45% sales tax rate in wentzville consists of 4.225% missouri state sales tax, 1.725% st charles county sales tax, 2.5%. Web you can. Auto Sales Tax Wentzville Mo.

From patch.com

Aldermen to Discuss Bringing Transportation Sales Tax Back in Front of Auto Sales Tax Wentzville Mo Web vehicles purchases are some of the largest sales commonly made in missouri, which means that they can lead to a hefty sales. The department collects taxes when an applicant applies for title. Web you can calculate the missouri sales tax on a car by multiplying the vehicle's purchase price by the missouri. The sales tax rate for wentzville was. Auto Sales Tax Wentzville Mo.

From www.commercialcafe.com

1500 East Highway A, Wentzville, MO 63385 Auto Sales Tax Wentzville Mo Web their website states ”you must pay the state sales tax and any local taxes of the city or county where you live (not where you. Web the 10.45% sales tax rate in wentzville consists of 4.225% missouri state sales tax, 1.725% st charles county sales tax, 2.5%. The sales tax rate for wentzville was updated for the 2020 tax. Auto Sales Tax Wentzville Mo.

From www.commercialcafe.com

1500 East Highway A, Wentzville, MO 63385 Auto Sales Tax Wentzville Mo The department collects taxes when an applicant applies for title. Web the 10.45% sales tax rate in wentzville consists of 4.225% missouri state sales tax, 1.725% st charles county sales tax, 2.5%. Web motor vehicle, trailer, atv and watercraft tax calculator. The sales tax rate for wentzville was updated for the 2020 tax year, this is the current sales tax. Auto Sales Tax Wentzville Mo.

From gmauthority.com

General Motors Wentzville Plant GM Authority Auto Sales Tax Wentzville Mo Web vehicles purchases are some of the largest sales commonly made in missouri, which means that they can lead to a hefty sales. Web sales tax in wentzville, missouri, is currently 8.45%. The department collects taxes when an applicant applies for title. Web you can calculate the missouri sales tax on a car by multiplying the vehicle's purchase price by. Auto Sales Tax Wentzville Mo.

From www.wentzvillemotors.com

WENTZVILLE MOTORS Car Dealer in Wentzville, MO Auto Sales Tax Wentzville Mo The department collects taxes when an applicant applies for title. The sales tax rate for wentzville was updated for the 2020 tax year, this is the current sales tax rate we are using in the. Web motor vehicle, trailer, atv and watercraft tax calculator. Web the 10.45% sales tax rate in wentzville consists of 4.225% missouri state sales tax, 1.725%. Auto Sales Tax Wentzville Mo.

From www.usatoday.com

GM in Wentzville is a comeback story Auto Sales Tax Wentzville Mo The department collects taxes when an applicant applies for title. Web the 10.45% sales tax rate in wentzville consists of 4.225% missouri state sales tax, 1.725% st charles county sales tax, 2.5%. Web vehicles purchases are some of the largest sales commonly made in missouri, which means that they can lead to a hefty sales. Web motor vehicle, trailer, atv. Auto Sales Tax Wentzville Mo.

From www.youtube.com

GM Plant in Wentzville YouTube Auto Sales Tax Wentzville Mo Web the 10.45% sales tax rate in wentzville consists of 4.225% missouri state sales tax, 1.725% st charles county sales tax, 2.5%. Web vehicles purchases are some of the largest sales commonly made in missouri, which means that they can lead to a hefty sales. Web their website states ”you must pay the state sales tax and any local taxes. Auto Sales Tax Wentzville Mo.

From krcgtv.com

Missouri governor signs GM tax break bill Auto Sales Tax Wentzville Mo The sales tax rate for wentzville was updated for the 2020 tax year, this is the current sales tax rate we are using in the. Web motor vehicle, trailer, atv and watercraft tax calculator. Web the 10.45% sales tax rate in wentzville consists of 4.225% missouri state sales tax, 1.725% st charles county sales tax, 2.5%. Web you can calculate. Auto Sales Tax Wentzville Mo.